Lithium shortage spells disaster for Biden admin’s ill-fated crusade against gasoline-powered vehicles

09/13/2022 / By Kevin Hughes

A lithium shortage might foil the Biden administration’s goal of decreasing the sale of new gasoline-powered vehicles by half.

“We don’t have enough [lithium] in the world to turn that much [battery] production in the world by 2035,” said Piedmont Lithium CEO Keith Phillips. He told Yahoo! Finance: “Yes, we’ll have enough – but not by that time. There’s going to be a real crunch to get the material.”

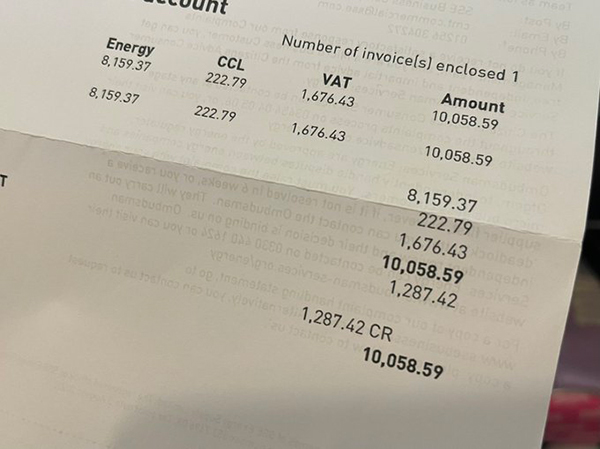

The price of lithium has nearly doubled from the previous year, with much of the short-term hike coming from outside the United States. That works against an Inflation Reduction Act tax credit that will need electric vehicle (EV) components to be obtained in North America.

Piedmont Lithium recently announced that it will begin constructing a lithium processing plant in Tennessee next year so that it can meet a demand level of enough lithium for one million automobiles a year when the EV car plants are up and rolling.

Phillips said “the world has changed” and “we’re now in an era where everyone’s going to want an electric car.” He added that the car companies can’t make them fast enough and people are now looking for the lithium they need for the batteries in the electric cars. (Related: Green cult now going after lithium – the key mineral used in batteries for electric vehicles.)

Simon Moores, chief executive of Benchmark Mineral Intelligence, told Reuters that it takes seven years to build a mine and refining plant but only 24 months to create a battery plant.

Max Reid, an analyst at WoodMac Battery Raw Materials Service, stated that the most feasible option is to use recycling. However, the impact of recycling will be very limited when there are hardly any EVs coming off the road. Battery metals advisor Chris Berry added that there is a serious challenge with lithium availability.

Kent Masters, chief executive of Albemarle, the largest publicly traded lithium producer, said the market will remain tight. Masters added that it is going to be systemic for a long period of time and it will stay tight for seven to eight years.

Lithium is becoming more expensive

Meanwhile, lithium is becoming much more expensive.

With prices hitting a record $78,000 a ton in April, Tesla CEO Elon Musk suggested the idea of mining and refining the lightweight metal itself because of the “insane” hike in costs.

According to Benchmark Market Intelligence, the price of lithium has soared more than 600 percent since the beginning of the year – from about $10,000 per metric ton in January to $62,000 in June. Citigroup expects more “extreme” price hikes on the way.

As reported by Platts Analytics, the high prices have been pushed by rising demand for light-duty EVs, with the sales doubling to 6.3 million units in the past year and expected to hit 26.7 million units by 2030.

Commodity price reporting agency FastMarkets has predicted that lithium supplies could completely collapse compared to demand as early as 2026.

After years of dropping prices, EVs are becoming more costly, canceling a trend that had the environmentally friendly cars on target to soon be price competitive against gas-powered vehicles.

Tesla has increased its prices by more than 20 percent since last year, putting its cars beyond the reach of millions of possible buyers.

Watch the video below to know why EVs are horrible for the environment.

This video is from the SecureLife channel on Brighteon.com.

More related stories:

Contrary to what people believe, electric vehicles are not cheaper than gas-fueled vehicles.

Sources include:

Submit a correction >>

Tagged Under:

batteries, big government, cars, collapse, demand, electric vehicles, energy supply, EV batteries, gasoline-powered vehicles, inflation, lithium, lithium mines, lithium prices, lithium supply, power, products, rationing, scarcity, shortage, supply chain

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 FuelSupply.news

All content posted on this site is protected under Free Speech. FuelSupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FuelSupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.